We can easily understand why investors like unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for several years while generating recurring revenue, if you had owned shares since 2005, you would have done well Of course. However, only a fool would ignore the risk that a losing company is burning through its money quickly.

Given this risk, we thought we would check it out Samsara (NYSE: IOT ) shareholders should be concerned about its firepower. In this article, we define profitability as the annual (negative) net income, which is how much the company spends each year to support its growth. We’ll start by comparing his income and savings to calculate his cash flow.

Choose a subtitle other than Samsara

How long does Samsara’s money flight last?

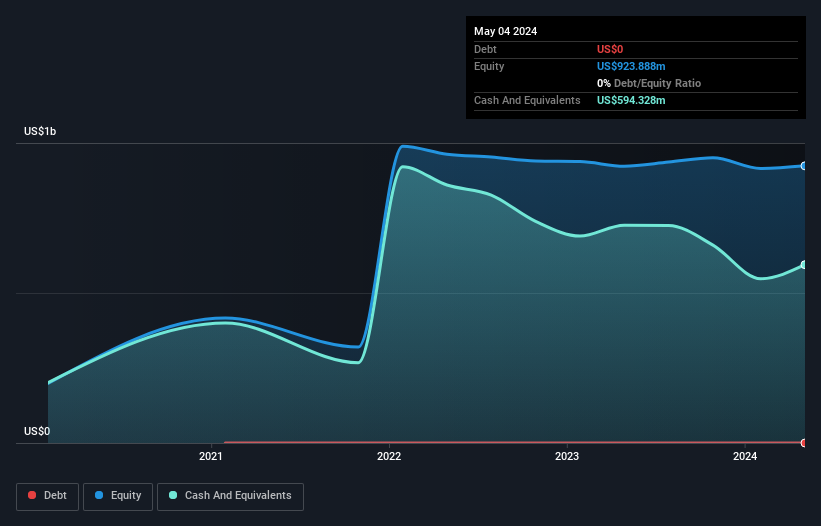

A company’s cash flow is calculated by dividing its cash flow by its cash flow. As of May 2024, Samsara has $594m in cash, and no debt. Looking at last year, the company burned through US $ 12m. Therefore, it has a long financial flight path of several years from May 2024. Obviously, however, analysts think that Samsara will break even (at the level of zero income) before then. If that happens, then his long financial flight, today, will become a waste. You can see how his financial balance has changed over time in the picture below.

How well does Samsara grow?

Samsara has managed to reduce its electricity consumption by 82% in the last 12 months, which shows that it is on the right flight path. Interestingly, this was achieved with the help of a 42% improvement in revenue. In general, we would say that its taste is interesting. However, clearly, the most important thing is whether the company will develop its business going forward. So you might want to look at how much the company is expected to grow over the next few years.

How hard will it be for Samsara to bring in more money for growth?

We’ve been impressed with Samsara’s progress over the past year, but it’s worth considering how expensive it will be if it needs to raise more capital to support rapid growth. Generally speaking, a listed business can raise new capital by issuing shares or taking debt. Many companies end up issuing new shares to fund future growth. By comparing the company’s annual electricity consumption with its total sales, we can estimate the amount of equity it will need to generate to sustain the company for the next year (at the same electricity price).

Samsara has a market capitalization of US$23b and burned from US$12m last year, which is 0.05% of the company’s market value. That means that it will be easier to provide a few funds to get more growth, and can be in a position to borrow cheaper.

How dangerous is the burning condition of Samsara?

It may already be clear to you that we are very happy with how Samsara is burning through its money. In particular, we think that his money runway appears as evidence that the company is well above his expenses. And even the revenue growth is encouraging. It is clear that it is good to see that analysts are predicting that the company will break even soon. Considering everything in this article, we are not worried about its fire, because the business shows enough to spend as necessary. Readers should have a thorough understanding of trading risks before investing in stocks, and we have seen 3 warning signs for Samsara that potential investors should keep in mind before investing in the stock.

Of course, you can find a good deal by looking elsewhere. So take a look at this for free a list of companies with a high index, as well as a list of growth stocks (according to forecasts)

New: Manage your entire Marketing Portfolio in one place

We have created final portfolio friend for investors, and it is free.

• Connect an unlimited number of portfolios and see your total in one fund

• Get notified of new alerts or threats via email or mobile

• Track the true value of your stocks

Try a free demo portfolio

Have feedback on this article? Thinking about content? Get in touch and we immediately. Alternatively, email editorial-team (at) simplywallst.com.

This article from Simply Wall St is general in nature. We provide information based on historical data and research forecasts only using unbiased methods and our articles are not intended to be financial advice. It is not a recommendation to buy or sell any product, it does not protect your interests, or your financial situation. We aim to bring you long-term focused research from our data base. Note that our analysis may not include the most recent or influential industry rankings. Only Wall St has no position in any of the stocks mentioned.

#Companies #Samsara #NYSE #IOT #invest #growth